Aegion Partners

Investing in the Frontiers of Defense, Industry & Innovation

Deploying capital into funds and companies shaping the next era of strategic independence.

Singapore | New York City

Aegion Partners is a principal investment firm deploying proprietary capital across defense, aerospace, critical metals, nanomolecular innovation, and next-gen energetics. Backed by deep sectoral expertise and global intelligence, we help institutional investors, sovereign funds, and family offices identify, structure, and execute high-value investments in frontier and strategic markets.

Our Asset Allocation division manages and deploys Aegion’s proprietary capital, leveraging over 20 years of expertise in global investment banking, fund structuring, and cross-border capital strategy to execute strategic investments across jurisdictions.

Areas of Sector Focus

Asset Allocation and Strategic Development

Institutional Execution & Multi-Jurisdictional Structuring:

We invest in multi-jurisdictional opportunities, structuring and deploying our capital across complex and globally exposed investments. Our Capital Allocation division is led by a Senior Managing Director with a long-standing track record in global investment banking, structured finance, and fund management—ensuring institutional-grade execution and alignment with best-in-class practices.

Early-Stage Platforms & Transnational Fund Development:

We invest in and support the growth of Next-Gen Technology and R&D-focused funds, targeting early revenue stages of high-impact ventures. Our structuring capabilities extend across direct equity vehicles, Funds of Funds, family offices, and sovereign platforms, enabling capital to access transformational innovation ahead of institutional adoption.

Conflict-Free Capital Strategy & Bespoke Partnerships:

Our investment strategy is guided solely by the interests of our internal deployment funds—ensuring clarity, objectivity, and conflict-free execution. We cultivate a select capital partner roster, enabling bespoke engagement models that prioritize long-term value creation, collaborative structuring, and discretion. Every engagement is opportunity-driven and structured to meet the unique risk/return thresholds of our partners.

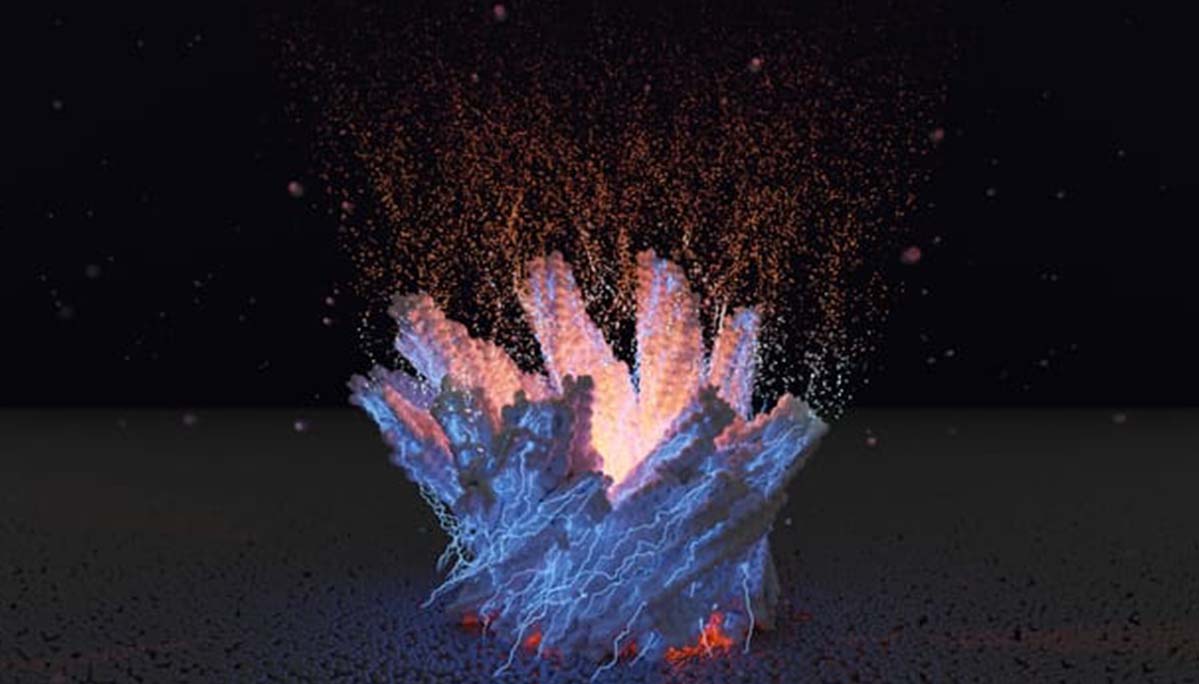

Nanomolecular Innovation & Next-Gen Energetics

Disruptive Materials & Molecular Platforms:

We evaluate breakthroughs in nanomaterials, molecular engineering, and biostructured compounds that enable transformative capabilities across defense, aerospace, energy, and health technology. This includes advances in lightweight composites, self-healing materials, adaptive coatings, and precision biointerfaces with strategic applications in complex, high-demand environments.

Next-Gen Energetics & Nanocatalytic Systems:

At the frontier of performance lies a new class of next-generation energetics—powered by nanocatalytic reactions, molecular-level energy transfer, and materials with tunable reactivity and energy density. We track and allocate into systems designed for in-flight, in-orbit, and compact battlefield environments, where power-to-weight ratio, thermal control, and reactivity precision are mission-critical.

Cross-Sector Applications & Strategic Timing:

We identify scalable nanomolecular platforms with dual-use potential, spanning energy storage, directed energy systems, aerospace propulsion, and tactical defense systems. Our capital is deployed based on inflection signals from IP ecosystems, R&D partnerships, and strategic procurement shifts, ensuring exposure to assets likely to benefit from national prioritization, supply chain protection, and government-backed acceleration.

Defense & Aerospace

Advanced Systems & Technologies: We analyze emerging defense and aerospace platforms—from unmanned aerial systems and next-gen propulsion to secure communications architectures—assessing their strategic viability, technological edge, and supply chain resilience. These insights inform capital positioning in sectors where innovation, regulation, and geopolitical relevance converge.

Next-Gen Energetics for In-Flight and In-Orbit Power Systems: We evaluate the investment implications of advanced energetic materials, directed energy systems, and alternative power architectures designed for in-flight and in-orbit applications. As energy systems become a decisive factor in the operational effectiveness of aerospace and defense platforms, we identify how next-gen power technologies are reshaping aerospace performance, defense capabilities, and the strategic competitiveness of national industrial bases.

Operational, Regulatory & Strategic Risk Alignment: We conduct structured assessments of supply chain integrity, compliance frameworks, and security protocols to de-risk capital exposure in sensitive transactions. Our understanding of export regimes, foreign investment restrictions, and geostrategic realignments supports resilient capital deployment in industries increasingly shaped by national security mandates and global competition.

Mining & Critical Metals

Integrated Resource & Demand-Side Assessments:

We evaluate the geological viability of mining sites, ore quality, and refining feasibility for strategic metals—while simultaneously analyzing how next-generation energetics and industrial transformations are reshaping demand for critical inputs such as lithium, rare earth elements, and high-energy-density materials.

End-to-End Value Chain Intelligence:

Our analysis spans the full strategic pipeline—from extraction and chemical processing to defense, aerospace, and energy applications. We map policy risks, strategic chokepoints, and supply chain asymmetries to uncover investable opportunities across jurisdictions and stages of value realization. This comprehensive approach enables capital deployment that is both technically informed and geopolitically resilient.

Strategic Resource Sovereignty & Jurisdictional Risk Profiling:

We assess how state control, bilateral trade policies, and industrial sovereignty strategies shape access to—and control over—strategic mineral assets. Through jurisdictional risk modeling and alignment with national critical minerals agendas, we identify where resource nationalism, infrastructure gaps, or export dependencies may disrupt or enhance long-term asset value. This intelligence informs sovereign-aligned investment theses, resilient offtake agreements, and secure supply structuring

Geopolitical & Geoeconomic Intelligence for Capital Allocation

Global Policy, Trade & Geoeconomics:

As a fund with exposure to transnational industries and cross-border deal flow, we integrate geopolitical and trade dynamics directly into our capital allocation process. We monitor how sanctions, bilateral agreements, resource nationalism, and regulatory shifts affect deal structures, capital mobility, and long-term asset performance. This enables us to position capital ahead of disruptions and align with high-yield, policy-resilient opportunities.

Anticipatory Allocation Strategy:

We integrate geopolitical foresight and geoeconomic intelligence across our capital allocation architecture to achieve two critical outcomes: resilience and advantage. Our models are built to anticipate systemic shocks—ranging from trade restrictions and macro-financial dislocations to industrial policy shifts and regional volatility—embedding protective measures directly into portfolio design. At the same time, we leverage scenario planning and inflection-point mapping to dynamically position capital for high-yield opportunities in structurally shifting markets. This dual-focus approach ensures that capital is continuously shielded from deterioration while remaining agile, opportunistic, and aligned with the future contours of global value creation.

Core Services

Deep-Dive Industry Analysis & Due Diligence

Technical & Operational Analysis: We conduct in-depth evaluation of design specifications, production capabilities, and refining methodologies to assess each opportunity’s technical feasibility, scalability, and geopolitical exposure. These insights directly inform our capital allocation decisions across critical sectors, such as defense, aerospace, and strategic resources.

Market, Competitive & Geoeconomic Dynamics: Our investment process integrates analysis of market structures, competitive positioning, and long-term demand trajectories while factoring in variables such as resource nationalism, trade restrictions, and macroeconomic realignments. This framework enables us to position capital ahead of inflection points, navigate structural risk, and deploy with high-yield in globally exposed industries.

Strategic Deployment

Scenario Planning, Geopolitics, & Capital Portfolio Integration: We design forward-looking deployment strategies that anticipate shifts in technology, resource access, geopolitical alignment, and energy transitions. These scenarios are embedded directly into our portfolio construction and capital allocation models, ensuring that invested capital, strategic assets, and supply chain exposures remain resilient as next-generation energetics and security architectures reshape global defense and industrial frameworks.

Confidential Reporting & Risk Intelligence: Our internal investment committees are equipped with granular, data-driven intelligence on trade restrictions, foreign investment controls, energy security risks, and economic leverage variables. This enables precise positioning across volatile geographies and sectors, ensuring each capital movement aligns with the fund’s risk parameters and strategic growth objectives.

Ongoing Monitoring & Support

Real-Time Intelligence for Asset-Class and Market Tracking: We maintain continuous oversight of developments in defense, aerospace, critical metals, next-generation energetics, and nanomolecular technology assets while actively—tracking relevant shifts across commodities, currencies, and equity markets. This multi-asset monitoring is fully integrated into our capital deployment framework, enabling timely adjustments in response to material changes in sector dynamics, pricing signals, or supply chain movements.

Capital Allocation Agility & Tactical Response: Our structure enables agile capital reallocation in response to market dislocations, regulatory updates, and macroeconomic shocks. This flexibility ensures disciplined exposure management and allows us to preserve alpha, hedge downside risk, and pursue tactical opportunities as market conditions evolve.

Approach & Methodology

Aegion Partners brings together a multidisciplinary team of exceptional professionals, combining institutional experience with deep domain specialization. Our team includes:

- Bankers, fund and portfolio managers, and financial allocation experts

- Economists, engineers, metallurgists, and core domain scientists

- High-level geopolitical and geoeconomic analysts

- Market researchers

This integrated expertise ensures that no critical dimension is overlooked—whether it involves:

- Chemical refining techniques and next-generation energetics

- Advanced nanotechnologies, drone/satellite systems, or aerospace platforms

- Unique engineering or material specifications

- Trade policy shifts, export control regimes, or regional geopolitical stability

Our interdisciplinary strength allows us to operate at the technical, financial, and strategic levels simultaneously—delivering precision and insight where it matters most.

Through partnerships across Asia, the Middle East, Africa, Europe, and the Americas, we maintain localized insight into regulatory environments, resource dynamics, labor conditions, and political climates. This global footprint enhances our ability to source, evaluate, and allocate capital into opportunities where local realities, macro context, and strategic execution intersect. It forms a foundational layer in our approach to due diligence, risk management, and long-term investment resilience.

Recognizing the sensitivity of projects in defense, aerospace, and high-value resource extraction, we employ secure communication protocols and strict non-disclosure agreements (NDAs) to safeguard client interests. Our commitment includes absolute discretion.

We rely on primary data, on-site inspections, expert interviews, proprietary modeling, and trade flow analysis. This combination of qualitative and quantitative methods, reinforced by geoeconomic forecasting, ensures that our recommendations are grounded in objective, verifiable facts that empower clients to make strategic, data-driven capital allocation decisions.

Why Choose Aegion Partners

Advantages of Our Proprietary Perspective: We view mining, critical metals, defense, aerospace, next-generation energetics, and nanobiomolecular technologies as an interconnected strategic value chain—shaped by a fusion of technological innovation, geopolitical pressure, and resource competition. These domains are no longer siloed; they are increasingly interdependent, with implications for energy security, industrial sovereignty, and supply chain resilience.

By combining technical expertise with deep geopolitical and economic intelligence, we identify and capitalize on risks and opportunities others overlook—positioning capital at the convergence of strategic necessity and future value creation.

- Unbiased Analysis-Driven Leadership: Our analyses, recommendations, and capital allocation choices are driven solely by client or our internal deployment fund interests, ensuring clear, objective, and conflict-free capital movement and opportunity-driven decision-making. Every decision is opportunity-driven, aligned with strategic priorities, and free from external influence or intermediary bias.

- Proven Impact: Our insights have supported the deployment of billions in institutional and private capital, empowering internal and external investors—including family offices, fund managers, and strategic capital allocators—to avoid critical pitfalls while capturing asymmetric upside across dynamic market conditions. We provide forward-looking guidance through market shifts, regulatory changes, and emerging trade dynamics, with particular focus on the disruptive impact of next-generation energy, aerospace systems, nanomaterials, and nanobiomolecular technologies; domains where early positioning is both decisive and durable.

- Tailored Engagement: We cultivate a select roster of capital partners and investors, allowing for meticulous attention, bespoke structuring, and high-touch engagement; particularly across our fund allocation spectrum. Each relationship is designed around discreet collaboration, with the objective of maximizing capital growth and building long-term, co-allocated financial partnerships rooted in strategic alignment and mutual value creation.

Contact & Next Steps

Contact us to explore co-investment opportunities and fund allocations led by Aegion Partners across defense, aerospace, mining, critical metals, nanomolecular innovation, and next-generation energetics.

We deploy proprietary capital and partner with institutional investors, family offices, and sovereign-linked entities to access high-yield, globally significant opportunities.

Use the secure form below to begin a confidential dialogue. We will respond with tailored engagement protocols aligned with your strategic objectives.